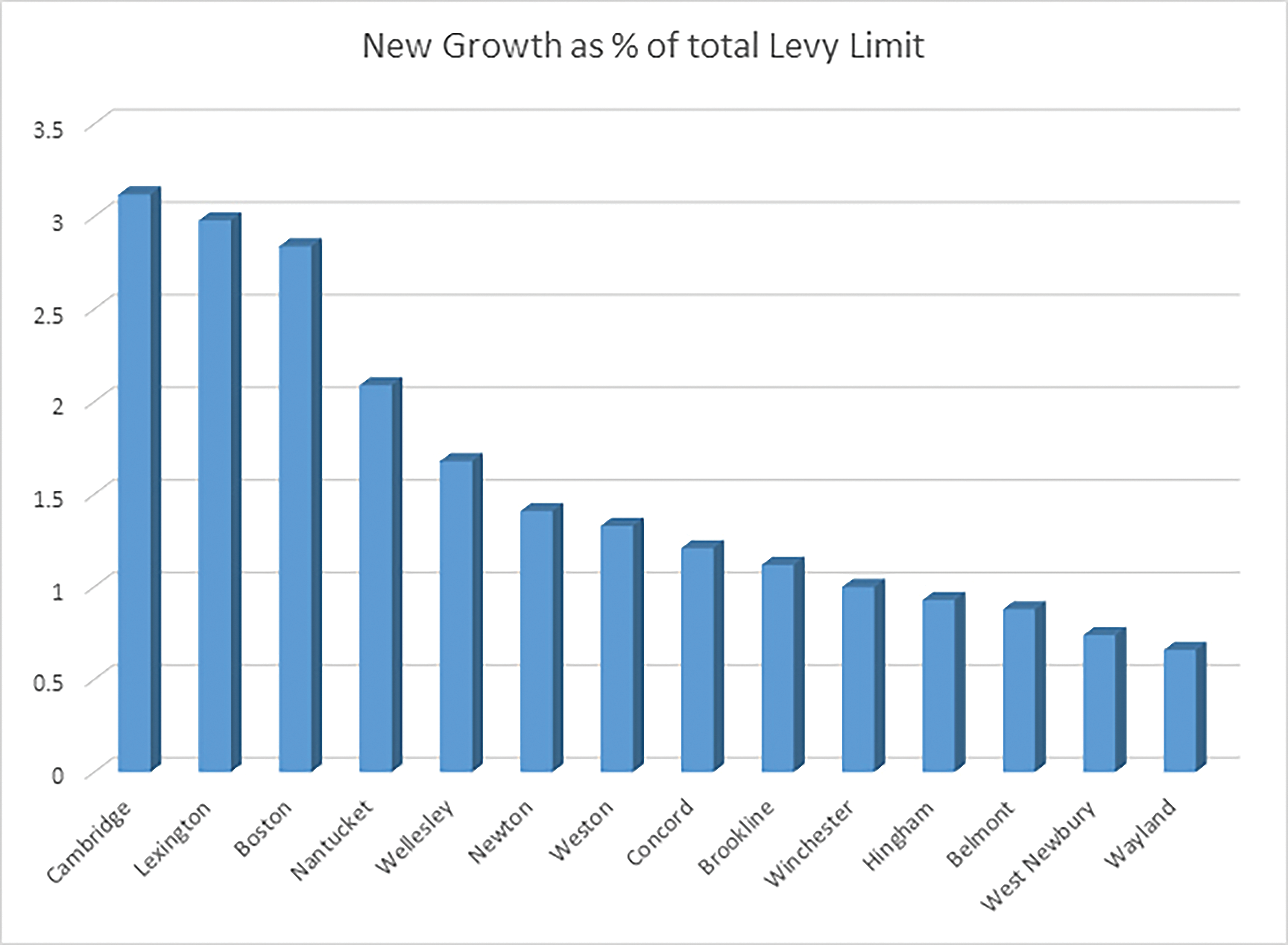

Wayland’s new construction growth rate ranks at the bottom for Moody’s Rating’s AAA-rated towns in Massachusetts.

There are 14 AAA towns and cities in the state, with growth rates ranging from Wayland’s 0.66% to Cambridge’s 3.12%, according to Finance Director Brian Keveny’s calculations. Weston, which is similar to Wayland, is ranked seventh with a 1.33% new growth rate. The new growth rate is calculated by dividing the annual new growth by the town’s levy limit.

Comparing its growth rate to all towns, Wayland’s growth rate is ranked 312 out of the 365 Massachusetts cities and towns. “Wayland is falling behind because it has not allowed any new large development other than Alta at River’s Edge in recent years,” Keveny said.

Keveny did not know why Weston had a better new growth rate than Wayland. He said the Weston Mill Creek project was not included in the recent new growth figures, but that when construction was completed, Weston’s growth rate would look even better. Wayland’s annual growth rate has consistently been between $300,000 and $500,000, according to Keveny.

The Wayland Mill Creek project was initially proposed for the site of a former Whole Foods Market on Boston Post Road in Wayland. When the Wayland Zoning Board of Appeals denied the special permit for the project, the Mill Creek developer filed an appeal with the state’s Housing Appeals Committee. However, the Mill Creek Developers canceled the Wayland proposal in February 2024 and ultimately withdrew the appeal.

Slow growth can impact a town’s bond rating because it may struggle to accommodate inflation or new capital costs. A smaller tax base can constrain a town’s fiscal capacity to pay for municipal services and its debt obligations. Keveny attributed Wayland’s low growth rate to the limited availability of vacant space, wetlands, conservation land, and the town’s aversion to large residential construction projects.

AAA is Moody’s highest ranking. If a town has a lower tax rating, it will not be as appealing to investors, and the interest rate the town pays its bond investors will be higher. State and local governments issue bonds to pay for large, expensive and long-lived capital projects such as roads, bridges, water treatment facilities, power plants, courthouses, schools and other public buildings. Although states and localities sometimes pay for capital investments with current tax revenues, borrowing allows them to spread the costs across many years. Future project users will bear some of the cost through higher taxes, tolls, fares and other charges that help service the debts.

New growth is determined by new construction, whether it consists of new residences or a building that is torn down and replaced. For example, if the old Bank of America building were torn down and replaced with a structure of the same size, it would be considered new growth, because the new building would have a higher valuation, resulting in increased taxes, Keveny said.

If the old Whole Foods building were torn down and replaced with condominiums, that would improve the new growth rate as opposed to filling the existing space with a new business. While new business in existing structures are still beneficial for the town, it does not generate the same level of tax revenue, according to Keveny, adding that the Mahoney’s lot has good growth potential.

The Select Board, Planning Board and Economic Development Committee promote new projects. The Finance Department doesn’t get involved until after a deal is closed, Keveny said.

Although Moody considers a town’s new growth rate when assigning a rating, it is not the only criterion considered. They also evaluate financial management, reserves, how liabilities are funded, and if the tax base is stable. Investors use ratings to inform their investment decisions.

Wayland’s AAA rating is not currently in jeopardy, Keveny said. Moody’s gave the town a AAA rating because it has a stable tax base, has aggressively funded Other Post-Employment Benefits (OPEB) and excluded a large portion of debt from the tax levy limits of Proposition 2½. OPEBs are benefits other than pension distributions, such as life insurance, health insurance, and deferred compensation, that employees can start to receive from their employer upon retirement.

However, Moody’s latest report says that as a AAA-rated town, Wayland has below-average reserves and limited revenue flexibility. It noted that the town’s outlook was stable because it is addressing its long-term liabilities while maintaining a conservative approach to budgeting and expenditure management. But Moody’s warned Wayland could be downgraded if it does not improve its fund balance as a percentage of revenues, can’t maintain structurally balanced budgets, and sizable debt issuance is not excluded from the levy limitation.

Moody’s does not evaluate the amount of debt a town assumes, but instead assesses the town’s ability to pay its debt and how close it is to its tax levy limit, according to Keveny. He said Wayland was given a warning in 2017 because it was funding OPEBs with free cash (money that town departments didn’t utilize). The town now funds long-term retirement pensions with the Middlesex County Retirement System. It will be fully supported in 10 years, according to Keveny.

Whether Wayland decides to finance the DPW building as a debt exclusion or within the tax levy doesn’t matter to Moody’s, although the firm prefers that capital projects be funded by debt exclusion, as Wayland did with the new Council on Aging Building, according to Keveny. He said Moody believes the levy funding should be reserved for a town’s operating expenses but agreed that the impact would be the same for taxpayers: higher taxes.

A “debt exclusion” is a Massachusetts ballot measure that allows a city or town to temporarily increase property taxes above the annual limit imposed by Proposition 2½ to fund a specific capital project, such as building a new school. Unlike a permanent tax override, the temporary additional tax is added to the tax levy only for the life of the debt. It does not become part of the base for future tax increases.

While slow population growth is a risk that rating agencies assess, it is not a direct trigger for a downgrade to the AAA rating, according to Keveny. A town with slow growth can maintain its top rating by demonstrating strong financial discipline, keeping debt and pension liabilities manageable, and maintaining healthy financial reserves. However, if the slow growth is coupled with poor management or other vulnerabilities, it can contribute to a lower rating and limit the number of new projects that the town can take on.